What Do You Get With Ovation Lending?

With an Ovation Property Tax loan, not only do you gain peace of mind, but you also stop the county penalties, interest, and collection fees from being added to your bill.

Just Like You… Even Candidates for Governor Can Have a Hard Time with Property Taxes

Property taxes are how local governments fund schools, emergency services, and many other programs and services that benefit our communities. They can sometimes be a heavy burden on those of us navigating some choppy financial waters and can have disastrous impacts on...

Frisco cuts tax bill for residents by boosting homestead exemption to 10%, hopes to be ‘model for the state

FRISCO — More property tax relief is on the way for Frisco homeowners. In a special meeting Friday, the City Council increased the homestead exemption from 7.5 percent to 10 percent. The change will provide an additional $47 in tax savings for a home valued at...

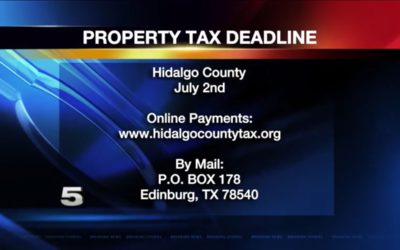

Hidalgo County Deadline to Pay Property Taxes on July 2

The Hidalgo County Tax Assessor-Collector’s Office is giving owners a chance to pay any unpaid balances in property taxes. Those with delinquent balances can make a payment by July 2 to avoid higher interest and penalties.

Important Things You Need to Know About Texas Property Taxes

About Texas property taxes According to the Texas Comptroller of Public Accounts, Property Taxes provide the largest source of funding for schools, streets, roads, police, fire protection and many other services. Local officials in determining the value for property,...

How to Use a Property Tax Loan to Your Advantage

Not everyone can afford to pay their property taxes by the due date set by the county. Even if you were planning and saving to pay your property taxes before they were due, unexpected things happen. Hospital bills, natural disasters, theft,...

The Watchdog: Abbott’s property tax plan? Wow! | Denton Record-Chronicle

Property taxes for many homeowners are going up the maximum 10 percent a year. Abbott proposes that local governments — city, county, hospital, college and school district — be allowed to jump only 2.5 percent in budget growth each year. Anything above that must go to...

Should I prepay my 2018 property tax bill: Key questions and answers

Can you save a lot of money by prepaying your property taxes? Key questions and answers. This story has been updated with new details about Internal Revenue Service guidance on prepaying property taxes and other changes to clarify how people should think about the...

5 Tricks For Lowering Your Property Tax

Property taxes can be extremely burdensome for a homeowner. They tend to rise steadily over time and, even once you pay off your mortgage, the taxes keep on coming. The good news, however, is that there are some things homeowners can do to lessen the pain – and the...

25 Most Delinquent Businesses In Bexar County

SAN ANTONIO - In order to operate a business in Bexar County, you have to pay taxes to the Bexar County Tax Assessor-Collector’s Office. But not everyone does -- or at least not on time. “The average taxpayer with a limited income is expected to pay their property...