What To Do If You Are Unable to Pay Property Taxes

It’s no secret that Texas property taxes are among the highest in the U.S. As real estate values across Texas trend upward, property taxes are becoming even more cumbersome. Ovation Financial Services works hand-in-hand with property owners who may need a little extra help paying off those lofty tax bills.

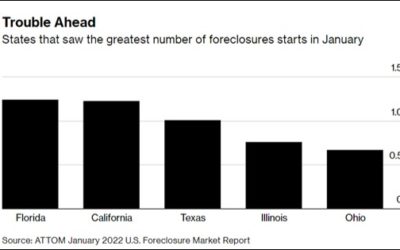

Foreclosures Around the U.S. Spike in January

According to a recent article published by Bloomberg News, the U.S. saw a surge in foreclosures during January when compared to the prior month and to the same month last year. 4,784 properties were repossessed in the month and another 11,854 homes started the...

What Should I Do If I Don’t Get a Property Tax Bill?

October is right around the corner and as most Texans start settling into their annual Fall routine of football, school, and colder weather, your local tax office is kicking off their annual process of sending out property tax bills to all property owners in their...

What Happens If You Fail to Pay Property Taxes in Texas

Local governments place liens on the properties every year, and these liens stay in place until the assessed taxes are paid. A failure to pay property taxes can be costly and have other severe consequences. In Texas, property...

How Soon Can You Get a Property Tax Loan

There are always various reasons that impact a property owner's ability to meet the Property Tax Deadline. However, it's critical that you have a solution identified prior to delinquency. A property tax loan is a reasonable solution that may meet your specific...

Phases of Appraisal Cycle

Property Taxes in Texas is the main source of income for the operation of government entities. Local appraisal districts set appraisal values based on a certain set of rules. Taxation should be fair & equitable Based on the current market value all tangible...

What If You Missed The Property Tax Deadline?

Property tax deadlines in Texas are heavy on property owners. And with this year’s January 31 deadline coming and gone, penalties, interest, & fees for missing that deadline are now increasing greatly for Property Taxes. If a property owner does not pay their...

Property Tax Tips for New Commercial Business Owners

Becoming a new business owner is an exciting time for any passionate entrepreneur. It's like a dream come true. But there is one event most business owners may not be aware of - Property Taxes. Whenever you receive your property tax assessment and tax bill, keep...

Overview of Tax Assessments

Property tax assessments are what determines how your property will be taxed. Due to this, even though your annual bill is significant, you can allocate your budget accordingly. What is Property Tax Assessment? A Property Tax Assessment determines the value of your...

Do You Understand Your Property Tax Bill?

Property owners in Texas are required to pay property taxes every year. Property taxes are something that must be paid but do you really understand your property tax bill? Texas is one of the only states that does not have a state property tax. The Texas Constitution...