What To Do if You Are Unable to Pay Property Taxes

Property Taxes: By StoryStudio January 19, 2022 9:00 AM

It’s no secret that Texas property taxes are among the highest in the U.S. As real estate values across Texas trend upward, property taxes are becoming even more cumbersome. Ovation Financial Services works hand-in-hand with property owners who may need a little extra help paying off those lofty tax bills. Whether residential, commercial, or small business-related, the right property tax loan can be an affordable solution to a stressful and time-consuming financial situation.

Waiting to Resolve Unpaid Property Taxes Only Leads to Higher Costs for Property Owners

Ovation understands that property taxes can go unpaid for a variety of reasons and every borrower is different. Whether it is an unexpected expense, a change in employment status, a reduction in hours, or a divorce, you may find yourself in an uncertain situation.

In many cases, people will inherit property from their parents or other family members and immediately need to assume unpaid property taxes. If the property is already paid-off and the family member inheriting the property is a first-time homeowner, they can be unaware of their obligation to pay the taxes. Similarly, many property owners don’t have taxes escrowed as part of their mortgages. Ovation can help.

“If you are unable to pay your property tax obligation in the state of Texas, it doesn’t go away,” says Jerry Morrison, CEO of Ovation Financial Services. “Whether you become an Ovation client, work with a family member, or arrange special payment terms with the county, it’s critical that property owners find a solution as quickly as possible.”

It’s important to be aware of the January 31 deadline to pay your property taxes for the previous year. As of February 1, if taxes are not paid, fees and fines can start escalating quickly.

If property taxes are not paid by the deadline, the county places a super-priority lien on the property. Under state statute, this super-priority lien must be paid before a property can be borrowed against or sold. Additionally, counties may file a lawsuit against property owners in order to collect the delinquent taxes. Every county is different, but these lawsuits can start as soon as the July following the January 31 deadline, creating a potential scenario where your property could be repossessed.

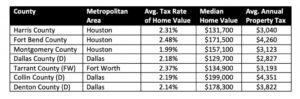

Approximate 2020 Property Taxes by Texas County*

*According to estimates from Tax-Rates

“It’s not unusual for people who owe money to not want to seek assistance,” Morrison says. “Ovation is here to help and our team is ready to work directly with property owners. They can call us to get a better understanding of the financing options available for their property. Nothing will change if you do not call…but if you do call us, we can work together to find potential solutions.”

One reason people might not reach out for help is because they believe the tax lien lender is filing a new lien on their property, although this is a common misconception.

“That scares them,” Morrison says about potential clients, “but what they don’t know is the county has already placed a lien on their property and we simply take the county’s position.”

Ovation pays the county directly on every client’s behalf and the super priority lien filed by the county is transferred to Ovation. The lien remains in place until the repayment agreement is repaid in full but the property owner is able to avoid additional county late fees and the risk of county repossession. Once the repayment agreement is repaid in full, the lien is released, granting the property owner complete peace of mind.

What to Do Next

Property taxes serve a critical purpose, generating revenue to fund essential community services such as public school systems. This is a primary reason local counties are so diligent in their penalties for not paying. However, if you’re unable to pay your property taxes, the good news is there are things you’re able to do! Even if a lawsuit has already been filed against you by the county, Ovation can still help.

“When people reach out to Ovation, we empathize with their situation,” Morrison says, referring to Ovation as a property tax relief company. “The first step we urge clients to take is reaching right back out to their local county to see what options are available to them.”

Counties typically offer split payment plans or occasional exemptions, but even then, some of these options are not financially feasible. For example, counties typically don’t extend payments beyond a single year since they aren’t set up as a bank.

“We have a more tailored custom plan that spreads payments out, reduces stress, and gets it under control through payment plans that are flexible,” Morrison comments. “Our goal is for them to be able to make their payments and at some point retire these loans, getting this setback off their plate so life returns to normal.”

The Process for New Clients

If you’ve decided that settling directly with the county isn’t your best option, Ovation will start with an internal valuation to estimate the value of the property in question, whether residential or commercial.

Next, one of their licensed loan officers will present several options, including a payment plan of up to 10 years. This can help to maintain your cash flow and keep payments low. “In just 20-30 minutes, we can gather the information and quickly provide an estimate of what the repayment plan will look like,” Morrison says.

The overall process works relatively quickly. Since the Ovation team knows that penalties start incurring from the county on February 1 and continue to add up month after month, they deliberately work at a rapid pace for your benefit.

“Altogether, a lot of our clients are looking at about a 38%-42% penalty on top of the taxes already owed,” Morrison says. “So, let’s say you missed $10,000 in payments, you’ll soon realize you now owe $14,000.”

Ovation works quickly to offer solutions and finalize the paperwork. The entire process takes as little as 3 or 4 days, ultimately putting a stop to the county penalties.

“We want our clients to be successful and customizing payments that fit within your budget is how we can get you back to a better place,” says Morrison.

Why Choose Ovation

What separates Ovation from other financial service teams comes down to their customer service and pricing. Ovation’s interest rates start at 9.99% and by law cannot exceed 18%, which is typically more favorable than what homeowners can obtain using a credit card or unsecured installment loan. Additionally, many Ovation clients have not established a credit history or have endured some financial hardship and cannot qualify for a traditional bank loan or credit card.

“There is typically no comparable financial product available to our customer base,” says Troy Ritter, Chief Investment Officer at Ovation. “We’re among the industry leaders in the pricing we offer, as well as the flexibility of terms. If a customer enters into a repayment agreement with us, they may qualify to delay making payments up to 12 months.”

Another convenient benefit of Ovation is they don’t sell their loans like most providers who chase an increased bottom line. This emphasizes just how important the customer service component is for Ovation.

“It’s a difficult time these property owners are in,” Jerry Morrison notes. “They’re angry in general over being in trouble, and there’s embarrassment involved. We know it’s stressful, which is why we listen to your needs and don’t just generate a loan to sell so we can move on to the next thing.”

The average loan from Ovation takes about four years to be paid back completely. Clients can use the full 10 years if they prefer or may want to get the loan paid off faster (with no prepayment fees for residential clients). Another service Ovation can provide upon request – which many competitors avoid – is to escrow taxes so succeeding years do not become delinquent as well. In a property tax escrow, one-twelfth of the expected annual property taxes for the next year are collected along with the monthly payment and are held in escrow until the next tax payment is due to the county.

Getting on the Path to Recovery

Jerry Morrison cites a portion of their mission statement: “We try to do everything within our power to keep hard-working Texans in their homes and their businesses.”

At the end of the day, for a company like Ovation Financial Services, a committed promise of this caliber says it all.

For a free, no-obligation quote, visit www.propertytaxloan.com/contact or call 833-933-2121 for more information.