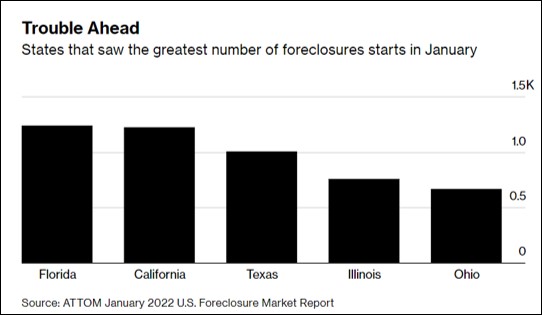

According to a recent article published by Bloomberg News, the U.S. saw a surge in foreclosures during January when compared to the prior month and to the same month last year. 4,784 properties were repossessed in the month and another 11,854 homes started the process. A lot of this is attributable to the end of safeguards that were put in place because of the pandemic. As normal operations around the country begin the process of getting back on track, it’s important to also recognize that your local property taxes and more importantly, unpaid property tax bills may receive a renewed focus as local- governments try collect the much-needed funding that support local infrastructure, emergency services, and school districts.

Property tax foreclosures are the end result of your local tax office attempting to collect unpaid property taxes. On the first Tuesday of every month, property owners with homes, vacant land, and commercial properties experience foreclosure and are forced to see their properties sent to auction because they did not find a solution to pay their property taxes.

This does not have to happen to you or your loved ones. Ovation Lending has helped thousands of Texans every year for the last decade find relief through a property tax loan. Choosing a property tax loan is a smart decision when faced with mounting penalties, interest, collection fees, lawsuit fees and even foreclosure. Ovation pays the county directly to bring your account current and then you repay Ovation over a term that fits your time frame. Repayment terms can go as long as 10 years if needed in -order to keep your monthly payments at a minimum.

Don’t let unpaid property taxes lead you to foreclosure!

Call Ovation Lending at 877-419-7392 to find out what options are available to you. A quick 5-minute phone call is all that is needed to determine if you qualify.