Do you know why property owners must pay property taxes in Texas? Property tax dollars help build and maintain infrastructures within counties and helps pay for other community services such as police and fire services. The importance of paying property taxes in Texas is huge for the development of the state and should not be taken for granted.

If you own property in Texas, whether it’s residential or commercial, you will have to pay property taxes. If you fall behind paying the property taxes, you can be assessed county penalties and interest on the unpaid amount and the property could face the possibility of tax foreclosure.

Texas Tax Foreclosure Process

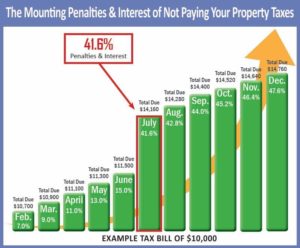

If property taxes are not paid by January 31st of each year, they are considered delinquent. Once delinquent, the county will start assessing penalties and interest on the unpaid amount on February 1st. Penalties and interest start at 7% and increases by 2% each month until July. On July 1st, the county collection firm can then assess up to a 20% collection fee and start the tax foreclosure process.

The first step to this process happens when a taxing unit files suit to collect on the delinquent taxes. The suit is usually filed by that taxing unit’s collection attorney. When this is done additional fees and court costs are added growing the delinquent tax amount even more. Once the taxes, penalties, interest, & fees are paid in full the property tax suit will be removed from the property. If taxes, penalties, interest, & fees remain unpaid then the collection attorneys will proceed in a county tax foreclosure. This is the final remedy to collect delinquent property taxes. The property will be sold on the courthouse steps the first Tuesday of the month to the highest bidder.

If you need help paying your property taxes give Ovation Lending a call. Whether it’s a residential property tax loan or a commercial property tax loan, we can save you from all the property tax hassles from penalties, interest, fees, court costs, & county tax foreclosure.

We make the process as simple as possible so you can make the easy decision to contact us at 877-419-7392 and speak to one of our licensed loan officers about your options.